WhatsApp Pay Has Officially Launched In India, But NPCI Doesn't Allow It To Have More Than 20 Million Users

Aadhya Khatri - Nov 09, 2020

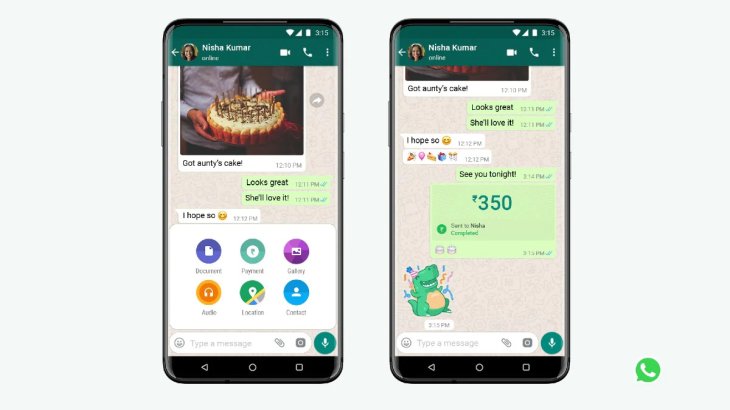

After two years of running in test mode and amassing over one million users, WhatsApp Pay has finally been launched in India

- Instagram Launches A Lite Version For Users In Rural And Remote Areas

- Australia Passed New Law That Requires Facebook And Google To Pay For News Content

- Facebook Stops Showing Australian Content, Even From Government Sites

After two years of running in test mode and amassing over one million users, WhatsApp Pay has finally been launched in India.

Facebook first introduced the service in 2018 but faced too many regulatory obstacles then to launch it as a full-fledged app.

WhatsApp Pay is built on UPI (short for Unified Payment Interface) – a standard defined by NPCI (National Payments Corporation of India). The app uses the same method as other similar apps like Paytm, PhonePe, and Google Pay.

WhatsApp partners with five banks in India to offer the service. In a video statement, Facebook’s CEO Mark Mark Zuckerberg said UPI has created a world of new opportunities for small and medium businesses – the Indian economy’s backbone.

He also remarked that India was the world’s first nation to do anything like this and expressed his excitement for the role WhatsApp Pay plays in achieving a digital India.

While the service is technically available to everyone in India, NPCI’s regulations forbid it to have more than 20 million users. The reason here is to avoid monopoly.

WhatsApp with its 400 million users in India is clearly a cause for concern. NPCI said the service would be allowed to grow in a graded manner but didn’t say when the next limit is issued.

It’s worth mentioning here that according to NPCI, no payment apps, including WhatsApp Pay and Google Pay, are allowed to process over 30% of transactions a month via UPI.

If NPCI allowed WhatsApp to launch the service to all of the platform’s 400 million users, it would obviously have a huge advantage on the Indian market.

For now, PhonePe and Google Pay are holding the largest shares of India’s UPI-based payment service. The two apps process 1.6 billion transactions from a total of 2 billion in October.

>>> Paytm Had Over 70 Crore Transactions in June, More Than Any Other UPI-Based Apps

Featured Stories

How To - Mar 04, 2026

Getting Started with AI: A Newbie's Simple Guide

ICT News - Mar 03, 2026

Budget Entry-Level PCs Under $500 to Vanish by 2028 Due to Memory Price Surge

ICT News - Mar 02, 2026

IDC Report Predicts Surging Smartphone Prices Due to Global RAM Shortage

ICT News - Mar 01, 2026

Samsung Links Galaxy S26 Price Hikes to AI Memory Supply Issues

ICT News - Feb 28, 2026

Anthropic Blacklisted by US Department of War: Trump Orders Federal Ban Over AI...

ICT News - Feb 26, 2026

AI Models Frequently Resort to Nuclear Escalation in Simulated Crises, Study...

ICT News - Feb 23, 2026

It's Over for Xbox: Asha Sharma Takes Over to Ruin Microsoft Gaming with AI

ICT News - Feb 22, 2026

Which AI Model Excels at Which Task in 2026: A Comprehensive Guide

ICT News - Feb 21, 2026

AI Coding Agent Causes Major AWS Outage at Amazon

ICT News - Feb 20, 2026

Tech Leaders Question AI Agents' Value: Human Labor Remains More Affordable

Read more

ICT News- Mar 03, 2026

Budget Entry-Level PCs Under $500 to Vanish by 2028 Due to Memory Price Surge

The era of the sub-$500 PC appears to be ending.

How To- Mar 04, 2026

Getting Started with AI: A Newbie's Simple Guide

Are you curious about artificial intelligence but not sure where to begin? You are not alone.

Comments

Sort by Newest | Popular