Here Is Everything You Need To know About The Apple Card

Aadhya Khatri - Jun 24, 2019

One of the most awaited product announced at Apple’s March event is the Apple Card. It is in the testing phase and will be launched this summer

- Best Gaming Phones 2025: Top Devices for Mobile Gaming

- Apple Kills Original HomePod, Focusing On HomePod Mini

- iPhone 12 Color Is Fading Away Quickly And No One Knows Why

One of the most awaited products announced at Apple’s March event is the Apple Card. As the company and its partner, Goldman Sachs bank advance forward with the testing phase, we have the chance to know more about this project.

Apple Card was introduced alongside some of Apple’s other new products like Apple News+ and Apple TV+. The card is Apple’s effort into the credit segment. It is believed that Apple has also negotiated with Citibank, but there is no partnership formed as the bank concerned about the profit this project can yield.

Apple Card Design

A credit card is not something new to the public, but Apple has made sure that the design of the card stands out. According to the company, the card will follow the minimalistic style. Its weight is about 14.75 grams.

On the front, the card will contain the cardholder’s name, a chip, and the Apple logo. On the other side, there is a credit card stripe, the logo of MasterCard, and the logo of Goldman Sachs.

The card does not feature any number on both sides, which might give you more security. If you want to see the number, you can access the Wallet app.

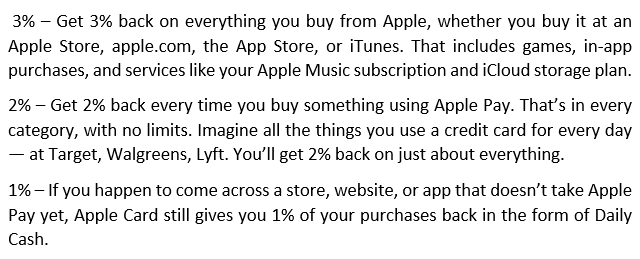

Rewards

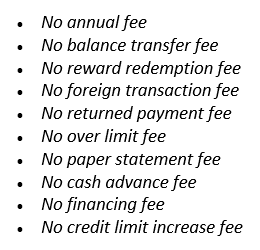

There is no annual fee so the public might have an incentive to switch to Apple Card. Apart from that, Apple also offers some rewards if you purchase with the card often.

You can have 3% back from purchases on iTunes, App Store, and Apple Stores. If you use Apple Pay, the cashback rate is 2%:

A nice offer from Apple is that there is no point conversions or rotating categories to keep an eye on. Your Apple Cash account will get Daily Cash at the end of each day.

Interest Rates And Approval Odds

It is believed that it takes only 1 minute to apply for the card because Apple has filled most of the information with data from your Apple ID. When the applying process has been completed, you will see an instant decision.

And about the approval odds? A source said that a person with a credit score between 600 and 700 might be approved with a credit line of $1,000.

This means Goldman Sachs may approve lots of customers for the Apple Card. However, if the credit score is low, you might be subjected to a higher interest rate and a tighter credit line.

Right after approval, users can have access to Apple Card immediately. The physical card will be sent by mail in one or two weeks.

Apple Card Setup

As with other accessories from Apple, you can set up the card with your iPhone. There is a pairing icon on the card’s envelope onto which you must tap your iPhone. Then, you will see an interface for setups like when you use HomePod or AirPods.

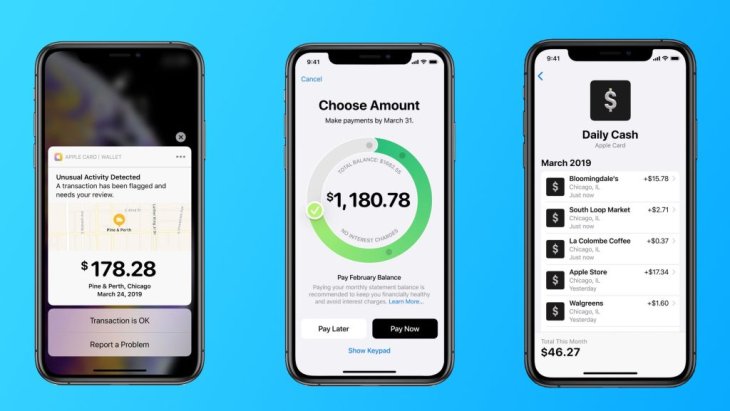

Security

Since the physical card will have no card number on it, you will have to access the Wallet app to see it. Users can also generate a new card number for each online purchase.

If Apple thinks the charge is fraudulent, users will receive notifications allowing them to approve the transaction or report a problem. When users need to report a fraud, they can do that by texting via the Messages app.

Apple said that it would not use your credit card data for marketing, as many other companies are doing:

Apple Wallet

One of the key selling points of Apple Card is its integration with Apple Wallet. For example, via the Apple Maps, you can see exactly where a transaction was made so that you can see the store name and other details. You can keep track of the Apple Card balance via an interactive ring.

You can schedule a payment on the weekly, biweekly, and monthly basis so that it falls in line with paydays. Apple explains:

Apple Card Fees

Apple said that the Apple Card would come with no fee, including late payment fee or annual fee.

If users miss a payment, they will not be charged an amount of late fee or subjected to the new high-interest penalty rate.

Release

Apple Card will be out this summer at the same time the company introduced iOS 12.4, which has updates for Apple Wallet app.

Featured Stories

ICT News - Feb 18, 2026

Google's Project Toscana: Elevating Pixel Face Unlock to Rival Apple's Face ID

Mobile - Feb 16, 2026

Xiaomi Launches Affordable Tracker to Compete with Apple's AirTag

ICT News - Feb 15, 2026

X Platform Poised to Introduce In-App Crypto and Stock Trading Soon

ICT News - Feb 13, 2026

Elon Musk Pivots: SpaceX Prioritizes Lunar Metropolis Over Martian Colony

ICT News - Feb 10, 2026

Discord's Teen Safety Sham: Why This Data Leak Magnet Isn't Worth Your Trust...

ICT News - Feb 09, 2026

PS6 Rumors: Game-Changing Specs Poised to Transform Console Play

ICT News - Feb 08, 2026

Is Elon Musk on the Path to Becoming the World's First Trillionaire?

ICT News - Feb 07, 2026

NVIDIA's Gaming GPU Drought: No New Releases in 2026 as AI Takes Priority

ICT News - Feb 06, 2026

Elon Musk Clarifies: No Starlink Phone in Development at SpaceX

ICT News - Feb 03, 2026

Elon Musk's SpaceX Acquires xAI in Landmark $1.25 Trillion Merger

Read more

ICT News- Feb 18, 2026

Google's Project Toscana: Elevating Pixel Face Unlock to Rival Apple's Face ID

As the smartphone landscape evolves, Google's push toward superior face unlock technology underscores its ambition to close the gap with Apple in user security and convenience.

Mobile- Feb 16, 2026

Xiaomi Launches Affordable Tracker to Compete with Apple's AirTag

For users tired of ecosystem lock-in or high prices, the Xiaomi Tag represents a compelling, no-frills option that delivers core functionality at a fraction of the cost.

Mobile- Feb 17, 2026

Anticipating the Samsung Galaxy S26 and S26+: Key Rumors and Specs

The Samsung Galaxy S26 series is on the horizon, sparking excitement among tech enthusiasts.

Comments

Sort by Newest | Popular