Report: The Premium Smartphone Market Of 2018 Grew 18%

Viswamitra Jayavant - Feb 01, 2019

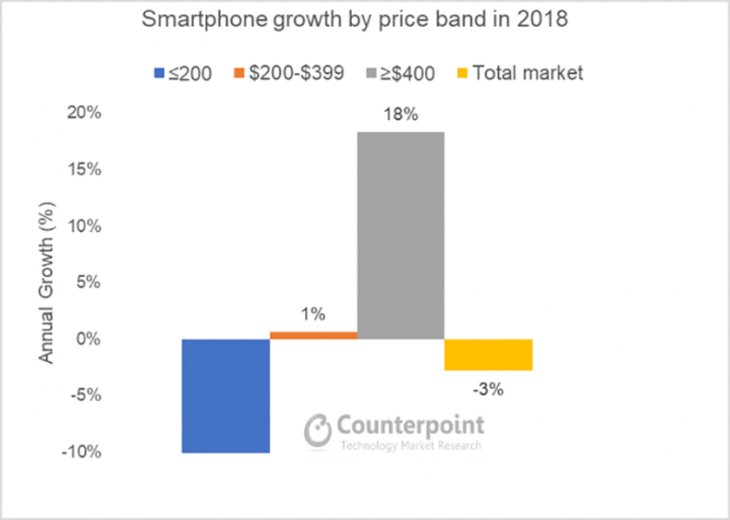

The report shows that the premium smartphone market has grown by 18% in 2018, revealing that people are willing to buy more expensive phones, but hold onto them for longer.

- iPhone Shipments Decreased 15% YoY For Apple’s Q3

- 42 Percent Companies Facing Difficulty In Hiring Tech Talent Globally

- More Apple Users Are Switching From iPhones to Samsung

Counterpoint Research - a high profile industry analysis firm has recently published a market research paper focusing on the premium market of smartphones in 2018. The report, uploaded on January 28th, assessed that the market for premium smartphones had grown 18% in 2018 compared to the data of 2017.

The growth in the premium market was counteracted by the decline of the overall industry by 3%.

All of the data is graphed into a bar chart below.

Counterpoint’s analysts had separated the market into three particular categories based on their wholesale price (Different than retail price).

The low-price, budget phones with pricing below $200 are represented by the blue bar.

Mid-range phones whose prices fluctuate between $200 to $400 are represented by the orange bar.

And lastly, data regarding the premium phones having a starting price of $400 and above is displayed in grey. As we can clearly see, the grey bar is the tallest data structure in the entire graph, showing significant growth of 18% in the past year.

To dissect further the interesting rise in the premium phone market, Counterpoint had broken down the premium category into three sub-categories. They are affordable premium phones ranging from $400 to $600, standard premium phones from $600 to $800, and the most expensive of them all - those having a price tag of $800 and up - are grouped into the ultra-premium sub-category.

Apple is currently the company dominating the ultra-premium category at 80% market share. Aside from the iPhone XR which was priced low enough to closely brush the top of the standard premium category at $750, the rest of the current iPhone line-up, including the iPhone XS and XS Max (The iPhone X was removed from production) are both in the high $1,000 range.

The runner-up of the market and own a sizeable portion of the rest 20% was Samsung, with the Samsung Galaxy Note 9. Companies such as Google also participated with its Google Pixel 3 XL. But these companies’ market share in comparison to Samsung and especially Apple was almost insignificant.

Apple did not only distinguish itself in the ultra-premium band, but it also dominated the larger premium category altogether (Above $400) at 51%. Samsung, once again, was the runner-up owning 22%. The third significant player was Huawei, at 10% of the premium’s market. The rest of the 17% is shared among a myriad of mostly Chinese smartphone manufacturers that had overtaken the market by storm in recent years. Xiaomi, Oppo, OnePlus, e.t.c are some of the familiar names that belong in this group.

While the data did say that Apple is the dominant force of the premium smartphone segment, companies are quickly catching up. One notable example is OnePlus who, after the resounding success of OnePlus 6, especially in India, managed to be the quickest growing manufacturer in the premium market.

You might be asking yourself what all of this data could possibly mean for you. The significant growth of the premium market we have observed from the data tells us that consumers nowadays are more willing to open their wallets to buy phones at a premium price. This is the reason why in the last couple of months, we have seen smartphone makers continuously announce devices that are priced at $500 to $1,000 and beyond.

The 3% fall in the entire smartphone market also tells us an interesting fact: Though consumers are willing to buy more expensive phones, they won’t buy new ones often anymore. In the past when phones are priced at an affordable $300 to $400, even for premium brands such as Apple, it is not unusual for consumers to buy a new phone every 2 or 3 years. Now that smartphone prices are rising and becoming larger investments, people tend to hold onto them for longer.

Companies will adapt to this line of thought and will begin to try and convince consumers in developed countries with higher spending power that smartphones at around the $400 range (Affordable premium) are the cheapest options.

We have already seen this strategy in action from Apple with the iPhone XR, touted to be an ‘affordable’ iPhone. It will probably be the same for the upcoming Samsung Galaxy S10. For developing markets like China and India, companies will focus more on their mid-range offerings and devices below $600. And for new markets like Africa, budget phones below $200 will spearhead the local smartphone economy.

Beginning with Apple’s controversial iPhone X’s pricing, for the first time, to hit $1,000. By analyzing the response of the market to such an expensive device, companies have realized that we’re still willing to open up to higher ceilings. And they gladly backed up that realization with more and more costly devices.

But whether the high pricing strategy that’s slowly becoming popular among phone makers are effective or not remain unseen. Apple and Samsung - the two leading companies in this practice - had had some pretty bad months from low sales. Companies will have to decide for themselves whether the market is either not ready, or it’s just because customers have yet to adjust to the new pricing schemes that they adopted.

One thing is for sure, though. From now on, if you really want a good phone, then be ready to pay more. And once you’ve gotten the phone of your dream, preserve and protect it as lovingly as you could. Because once it has given out on you, expect your bank account to be severely hurt if you want a new, good one.

Featured Stories

ICT News - Feb 18, 2026

Google's Project Toscana: Elevating Pixel Face Unlock to Rival Apple's Face ID

Mobile - Feb 17, 2026

Anticipating the Samsung Galaxy S26 and S26+: Key Rumors and Specs

Mobile - Feb 16, 2026

Xiaomi Launches Affordable Tracker to Compete with Apple's AirTag

Mobile - Feb 14, 2026

Android 17 Beta 1 Now Available for Pixel Devices

Mobile - Feb 12, 2026

What is the Most Powerful Gaming Phone Currently?

Mobile - Feb 11, 2026

Top 5 Cheap and Efficient Gaming Phones in 2026

Mobile - Jan 31, 2026

Generalist vs Specialist: Why the Redmi Note Series Remains Xiaomi's Easiest...

Mobile - Jan 30, 2026

Motorola Unveils Moto G67 and Moto G77: 5200mAh Battery, 6.78-Inch AMOLED Display,...

Mobile - Jan 30, 2026

Red Magic 11 Air Debuts Worldwide: Snapdragon 8 Elite Powerhouse with Advanced ICE...

Mobile - Jan 29, 2026

Guide to Sharing Your Contact Card via the mAadhaar App

Read more

ICT News- Mar 01, 2026

Samsung Links Galaxy S26 Price Hikes to AI Memory Supply Issues

This development highlights the broader challenges faced by the tech industry as it integrates artificial intelligence into everyday consumer electronics.

ICT News- Mar 03, 2026

Budget Entry-Level PCs Under $500 to Vanish by 2028 Due to Memory Price Surge

The era of the sub-$500 PC appears to be ending.

ICT News- Mar 02, 2026

IDC Report Predicts Surging Smartphone Prices Due to Global RAM Shortage

This development underscores the broader ripple effects of the AI boom on everyday technology, highlighting the interconnected nature of global semiconductor supply chains.

Comments

Sort by Newest | Popular