Despite Mocking Credit Cards, Apple Now Launches Its Own Apple Card

Dhir Acharya - Mar 26, 2019

Not only will Apple Card live virtually in the Wallet app but it will also in a physical form as a titanium card with the laser-etched, minimalist design.

- Best Gaming Phones 2025: Top Devices for Mobile Gaming

- Apple Kills Original HomePod, Focusing On HomePod Mini

- iPhone 12 Color Is Fading Away Quickly And No One Knows Why

The iPhone store your credit card info, but that’s not enough for Apple, it wants to expand to the physical card too.

At its Show Time event last night, the company announced Apple Card. Not only will the card live virtually in Apple’s Wallet app but it will also in a physical form as a titanium card with the laser-etched, minimalist design. The Cupertino-based company will launch the virtual card in the US this summer.

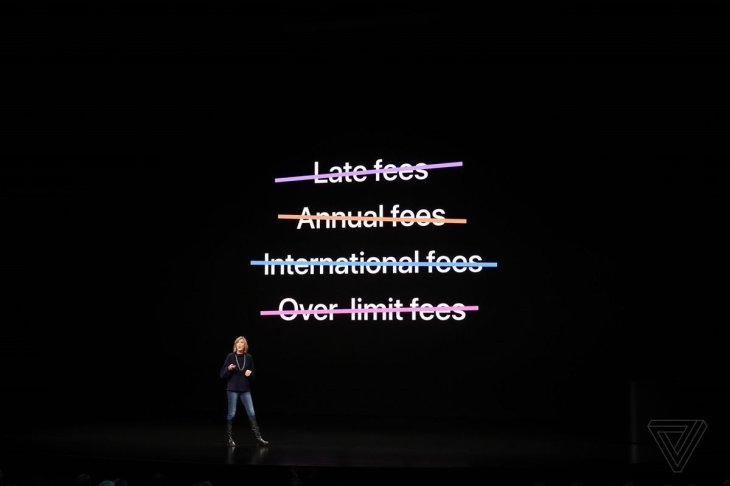

As stated by the tech giant, everything that people hate about credit cards will be removed, like annual fees, late fees, international fees, and penalty interest rates. Tim Cook said:

A critical point that may help Apple turn heads with this card is cash-back rewards, which is different from monthly rewards from other cards. In particular, whenever making payments with Apple directly, customers will get 3 percent cash back, paying with the virtual card means 2 percent cash back, and paying with the physical card means 1 percent.

The announcement about Apple Card comes around four years after the launch of Apple Pay, a service aiming at replacing wallets and physical credit cards with phone-based payments.

Back in 2014, while speaking in a press event, Cook said that for ages, people have wished to replace them, referring to credit cards, along with announcing Apple Pay. Cook claimed that cards are bulky and easy to lose.

However, the company has seen slow adoption of Apple Pay. PYMNTS.com pointed out in its study that less than 33 percent of iPhone users have used Apple Pay at least once and the situation seems not to get better even after years of efforts to push Apple Pay to more websites and retailers. Eventually, the company made the decision to change its way of growing in payments as well as building up its mobile wallet user base.

This move is also in line with Apple’s plans to strengthen its services, currently including apps, games, cloud storage, and music streaming.

And that’s how something Apple used to mock now becomes its new strategy.

Meanwhile, CreditCards.com’s industry analyst Ted Rossman said on Monday, “Frankly, I'm underwhelmed.” He also said that customers may get even more cash back without Apple Pay, like with Citi Double Cash offering 2% cash back on every purchase.

Featured Stories

ICT News - Feb 18, 2026

Google's Project Toscana: Elevating Pixel Face Unlock to Rival Apple's Face ID

Mobile - Feb 16, 2026

Xiaomi Launches Affordable Tracker to Compete with Apple's AirTag

ICT News - Feb 15, 2026

X Platform Poised to Introduce In-App Crypto and Stock Trading Soon

ICT News - Feb 13, 2026

Elon Musk Pivots: SpaceX Prioritizes Lunar Metropolis Over Martian Colony

ICT News - Feb 10, 2026

Discord's Teen Safety Sham: Why This Data Leak Magnet Isn't Worth Your Trust...

ICT News - Feb 09, 2026

PS6 Rumors: Game-Changing Specs Poised to Transform Console Play

ICT News - Feb 08, 2026

Is Elon Musk on the Path to Becoming the World's First Trillionaire?

ICT News - Feb 07, 2026

NVIDIA's Gaming GPU Drought: No New Releases in 2026 as AI Takes Priority

ICT News - Feb 06, 2026

Elon Musk Clarifies: No Starlink Phone in Development at SpaceX

ICT News - Feb 03, 2026

Elon Musk's SpaceX Acquires xAI in Landmark $1.25 Trillion Merger

Read more

ICT News- Feb 18, 2026

Google's Project Toscana: Elevating Pixel Face Unlock to Rival Apple's Face ID

As the smartphone landscape evolves, Google's push toward superior face unlock technology underscores its ambition to close the gap with Apple in user security and convenience.

Mobile- Feb 16, 2026

Xiaomi Launches Affordable Tracker to Compete with Apple's AirTag

For users tired of ecosystem lock-in or high prices, the Xiaomi Tag represents a compelling, no-frills option that delivers core functionality at a fraction of the cost.

Mobile- Feb 17, 2026

Anticipating the Samsung Galaxy S26 and S26+: Key Rumors and Specs

The Samsung Galaxy S26 series is on the horizon, sparking excitement among tech enthusiasts.

Comments

Sort by Newest | Popular