Indian Startups Raised An Impressive $3.9 Billion In The Last 6 Months

Arnav Dhar - Jul 17, 2019

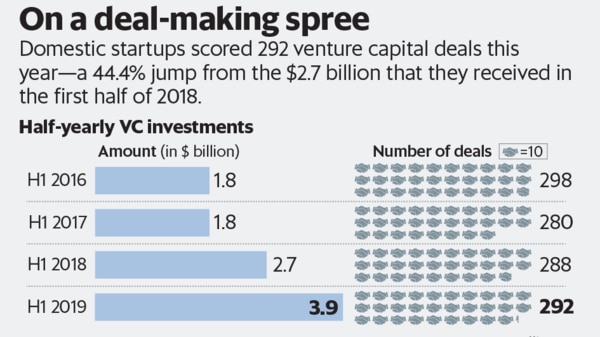

$3.9 billion was raised by Indian startups in the first 6 months of 2019, a sharp 44.4% increase from this period last year.

- Delhi Is The World’s Most Polluted Capital City For Three Years In A Row

- Indian Farmers Install High-Tech, Night-Vision CCTV Cameras To Protect Themselves

- Looking For The Best Electric Bike In India 2021? Take A Look At These

$3.9 billion was raised by Indian startups in the first 6 months of 2019, a sharp 44.4% increase from this period last year. The sheer amount of money didn't only come to giants like Flipkart or Ola but also to a wider set of companies in all sectors. The data is recorded by Venture Intelligence.

This year's investments are also nearly equal to what Indian firms received in the whole years of 2016 and 2017, which respectively marked $4.2 billion and $4.3 billion. This means we are seeing a great surge of venture capital in the last 18 months.

Both very early-stage investments and series F fundings for younger-than-10-year-old companies are counted into the data.

According to Sandeep Murthy, a professional investor from Lightbox Ventures, some companies have come up with how to solve "truly unique problems" are seeing growth as backed by outside capital fundings.

But the amount of investments doesn't only come to large consumer internet companies alone. Logistics-related, software B2B are seeing money flowing in also.

As per Murthy:

Recent billion-dollar deals such as the Flipkart case are considered the motivation for India's surge in investments. The giant e-commerce platform was purchased by US biggest retailer Walmart with $16 billion, which made the firm's investors up 50% to tenfold their ventures. Some of the big winners are Japan-based Softbank and American Tiger Management.

Mukul Arora, who invested in Softbank's Paytm and food deliverer Swiggy, said about the Flipkart effect:

According to Arora, investments are becoming more "aggressive" even in earlier-stage deals, which formerly occurred to later-stage deals.

Murthy said:

As the investments in Indian startups start booming, investors are also becoming more cautious and are aiming towards higher-valuation businesses. According to Murthy, he would rather pay a little more for a better business than get a cheap deal with an ineffective one.

Featured Stories

Features - Jan 29, 2026

Permanently Deleting Your Instagram Account: A Complete Step-by-Step Tutorial

Features - Jul 01, 2025

What Are The Fastest Passenger Vehicles Ever Created?

Features - Jun 25, 2025

Japan Hydrogen Breakthrough: Scientists Crack the Clean Energy Code with...

ICT News - Jun 25, 2025

AI Intimidation Tactics: CEOs Turn Flawed Technology Into Employee Fear Machine

Review - Jun 25, 2025

Windows 11 Problems: Is Microsoft's "Best" OS Actually Getting Worse?

Features - Jun 22, 2025

Telegram Founder Pavel Durov Plans to Split $14 Billion Fortune Among 106 Children

ICT News - Jun 22, 2025

Neuralink Telepathy Chip Enables Quadriplegic Rob Greiner to Control Games with...

Features - Jun 21, 2025

This Over $100 Bottle Has Nothing But Fresh Air Inside

Features - Jun 18, 2025

Best Mobile VPN Apps for Gaming 2025: Complete Guide

Features - Jun 18, 2025

A Math Formula Tells Us How Long Everything Will Live

Read more

ICT News- Feb 28, 2026

Anthropic Blacklisted by US Department of War: Trump Orders Federal Ban Over AI Safeguards Dispute

The story is developing. Federal agencies have been instructed to begin transition planning immediately.

ICT News- Mar 02, 2026

IDC Report Predicts Surging Smartphone Prices Due to Global RAM Shortage

This development underscores the broader ripple effects of the AI boom on everyday technology, highlighting the interconnected nature of global semiconductor supply chains.

ICT News- Mar 01, 2026

Samsung Links Galaxy S26 Price Hikes to AI Memory Supply Issues

This development highlights the broader challenges faced by the tech industry as it integrates artificial intelligence into everyday consumer electronics.

Comments

Sort by Newest | Popular