If You Do Not Do This, Your Debit/Credit Cards May Be Deactivated

Indira Datta - Dec 01, 2018

Banks have been informing their account holders about upgrading their credit and debit cards. Here's some information that cardholders need to know.

- This Thief Stole 1,300 Customers’ Credit Card Info Using His Memory

- Apple May Introduce Its Credit Card In The First Half Of August

- Paytm Now Releases Credit Cards In Partnership With Citibank

Banks sent a message to their customers requesting debit/credit cards upgrades. Most likely people think this message is spam and ignore it. Take note of this message because you are also probably be affected. Almost all banks have informed their account holders. But if you have not received any news yet, please contact your bank for direct consultation and explanation.

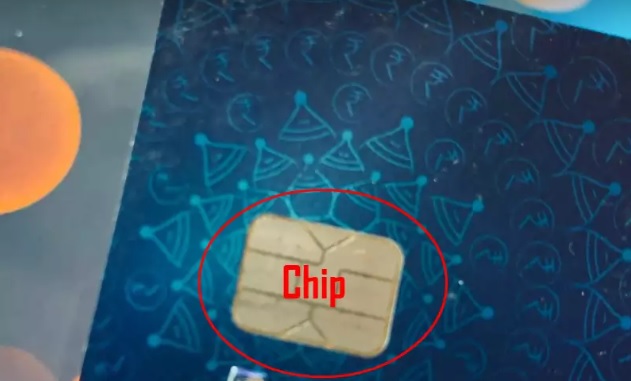

Existing standard credit and debit cards are magnetic only. The payment data in the new EMV card is supported by the chip, which is more secure than the magnetic card. If the previous magnetic stripe cards had customer information stored in the black band at the back of the card, the EMV card would store the customer's information dynamically. This will help prevent scammers from copying data from traditional magstripe cards with skimming devices. With EMV cards, users are assured of avoiding thieves, fraudulent frauds and tampering the cards.

Your card will stop working if you do not upgrade your card before December 31st. Now you should review your bank’s message and replace your credit card and debit card with a new EMV card if you have not already done so. This was directed by the Reserve Bank of India (RBI) to domestic banks. Accordingly, owners of magnetic stripe cards must switch to EMV chips before December 31, 2018, as from January 1, 2019, old cards will no longer work. Due to the poor security of magnetic stripe cards that could easily be stolen, the government urged people to switch to EMV chips. The RBI directive applies to both debit and credit cards in the country and internationally.

Your bank account and information will be safer with your EMV card. The EMV card is a smart card (Europay, Mastercard, Visa), which stores information so much more secure than the magnetic stripes that people still use today. EMV cards are also known as IC cards or chip cards, which generate dynamic data each time a user uses them to make a transaction. This makes it impossible for the crooks to copy or steal your card information to duplicate or clone your card.

If you wonder whether your current card is an EMV card or one of the cards will be locked shortly, check your card. By looking at the chip on the left side of the card, it looks like a sim. If there is a chip in place, you can safely use the card without changing it.

Compared to the previous multi-user card, EMV-based credit and debit cards are much more safe and secure. The EMV card is based on chips to encrypt the data stored through the PIN code of the card (Personal Identification Number). This is an advanced storage technology and the ability to encrypt data higher.

Currently, all banks will automatically replace the new credit and debit cards for customers. People who switch to EMV will not have to pay any fees. You can get a new EMV card through your registered address or any other address by registering at your nearest bank branch. Through Internet Banking, you can request a new EMV card without having to go to the bank.

RBI mandates banks to redeem their cards free of charge for new cardholders and after January 31, 2016. EMV chip cards that have been in service before January 31, 2016, if owners want to change into new cards, they must pay the changing fee to the banks

There are changes in the transaction through a point of sale machine (POS) with these new cards. Previously, to pay with a magnetic stripe card, users only need to swipe it through the POS device to complete the transaction. But now, with the EMV card, the cardholders must enter the PIN to the POS to complete the transaction. This increases the level of security for users.

Although security has improved, online transactions will still be risky if you share critical information related to your card to unknown people or unreliable friends. It is best to have a new PIN for your EMV card, instead of keeping your PIN the same as your old card.

Featured Stories

ICT News - Feb 20, 2026

Tech Leaders Question AI Agents' Value: Human Labor Remains More Affordable

ICT News - Feb 19, 2026

Escalating Costs for NVIDIA RTX 50 Series GPUs: RTX 5090 Tops $5,000, RTX 5060 Ti...

ICT News - Feb 18, 2026

Google's Project Toscana: Elevating Pixel Face Unlock to Rival Apple's Face ID

Mobile - Feb 16, 2026

Xiaomi Launches Affordable Tracker to Compete with Apple's AirTag

ICT News - Feb 15, 2026

X Platform Poised to Introduce In-App Crypto and Stock Trading Soon

ICT News - Feb 13, 2026

Elon Musk Pivots: SpaceX Prioritizes Lunar Metropolis Over Martian Colony

ICT News - Feb 10, 2026

Discord's Teen Safety Sham: Why This Data Leak Magnet Isn't Worth Your Trust...

ICT News - Feb 09, 2026

PS6 Rumors: Game-Changing Specs Poised to Transform Console Play

ICT News - Feb 08, 2026

Is Elon Musk on the Path to Becoming the World's First Trillionaire?

ICT News - Feb 07, 2026

NVIDIA's Gaming GPU Drought: No New Releases in 2026 as AI Takes Priority

Read more

ICT News- Feb 19, 2026

Escalating Costs for NVIDIA RTX 50 Series GPUs: RTX 5090 Tops $5,000, RTX 5060 Ti Closes in on RTX 5070 Pricing

As the RTX 50 series continues to push boundaries in gaming and AI, these price trends raise questions about accessibility for average gamers.

ICT News- Feb 18, 2026

Google's Project Toscana: Elevating Pixel Face Unlock to Rival Apple's Face ID

As the smartphone landscape evolves, Google's push toward superior face unlock technology underscores its ambition to close the gap with Apple in user security and convenience.

ICT News- Feb 20, 2026

Tech Leaders Question AI Agents' Value: Human Labor Remains More Affordable

In a recent episode of the All-In podcast, prominent tech investors and entrepreneurs expressed skepticism about the immediate practicality of deploying AI agents in business operations.

Comments

Sort by Newest | Popular