Apple's Revenues Are Still Rising Despite The Company's Value Dropping Below $ 1tn

Indira Datta - Nov 06, 2018

Despite increase in the sale figures and revenues of iPhone, Apple's share still fall by 7% in after-hours trading, dropping Apple's value to below $1 tn

- Best Gaming Phones 2025: Top Devices for Mobile Gaming

- How to unlock a disabled iPhone: a step-by-step guide

- Apple Kills Original HomePod, Focusing On HomePod Mini

On Thursday, Apple shares fell 7% in after-hours trading. Revenue for the past three months has grown steadily, though sales have not increased significantly, thanks to the company's higher iPhone price strategy.

Turnover rose 20 percent to $ 62.9 billion compared to last year and profit grew 31 percent to $ 14.1 billion. But as Apple sales are warned to be likely to drop in the next few months, the price of the company's stock dropped after the transaction ended.

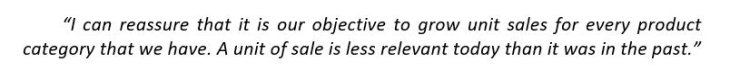

The sale of shares accelerated faster than after Apple announced last week that they would stop disclosing figure of product sold.

All of the company's executives have since decided not to announce the number of units sold as it does not represent the financial health of the company. According to analysts, this is Apple's obscurity, which makes it hard to track its sales performance and status.

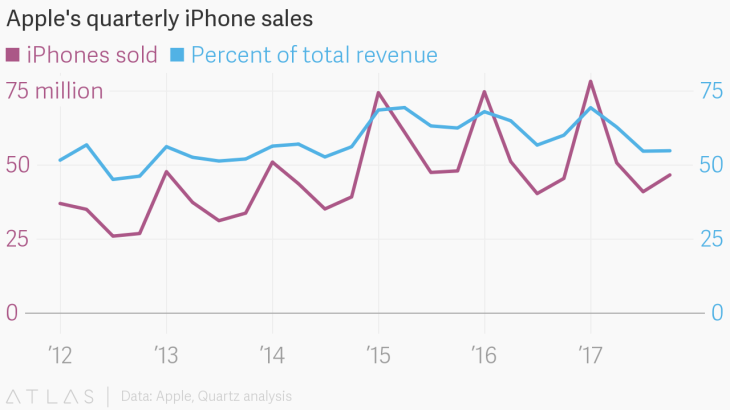

By 2017, the global sale figure of smartphone of all smartphone vendors declined for the first time. But for Apple, increasing the price of its iPhone has helped ease the pressure on sales of products.

In the third quarter of 2018, 46.9 million iPhones have been sold, a very insignificant increase compared to 46.7 million smartphones shipped in the same quarter in 2017.

Apple has gained a lot of revenue thanks to services such as Apple Store, Apple Pay and Apple Music. As a result, the services alone contributed $ 10 billion of revenue in the third quarter this year.

This year, Apple's revenue jumped 16 percent to $ 265.5 billion and corporate profits rose 23 percent to $ 59.5 billion. Apple's chief financial officer - Luca Maestri, told financial analysts:

Conversely, despite record sales, the company's shares fell in after-hours trading, a 4% reduction followed by another 7% fall. They then tried to pull back and lift the value of the company to more than $ 1tn.

The negative forecast for this important Christmas period is one of the reasons for the decline. While Wall Street forecasts Apple's sales of $ 93 billion in the next three months, Apple expects its revenue to fluctuate between $ 89bn and $ 93bn. Last year, the company had $ 88.3 billion in revenue.

Apple CEO Tim Cook said the company was "seeing some macroeconomic weakness in some of the emerging markets, including Russia, Brazil, India and Turkey. He added that currency fluctuations are one of the causes.

Luca Maestri, Apple's CFO, said the company is currently facing problems with its offering and launch of its latest offerings.

Trade tension between the US and China is likely to have a greater impact on Apple's production in China. However, Apple products have not been affected by tariff policies.

Still, Tim Cook is optimistic about the issue and thinks the two nations will have a proper solution to their problem. He said Apple is not affected negatively, instead, it has grown 16% in Greater China in the last few quarters.

In addition, he also spoke about China's ban on games in the Apple Store, saying that this is a problem for China, not Apple's concern.

Featured Stories

How To - Mar 04, 2026

Getting Started with AI: A Newbie's Simple Guide

ICT News - Mar 03, 2026

Budget Entry-Level PCs Under $500 to Vanish by 2028 Due to Memory Price Surge

ICT News - Mar 02, 2026

IDC Report Predicts Surging Smartphone Prices Due to Global RAM Shortage

ICT News - Mar 01, 2026

Samsung Links Galaxy S26 Price Hikes to AI Memory Supply Issues

ICT News - Feb 28, 2026

Anthropic Blacklisted by US Department of War: Trump Orders Federal Ban Over AI...

ICT News - Feb 26, 2026

AI Models Frequently Resort to Nuclear Escalation in Simulated Crises, Study...

ICT News - Feb 23, 2026

It's Over for Xbox: Asha Sharma Takes Over to Ruin Microsoft Gaming with AI

ICT News - Feb 22, 2026

Which AI Model Excels at Which Task in 2026: A Comprehensive Guide

ICT News - Feb 21, 2026

AI Coding Agent Causes Major AWS Outage at Amazon

ICT News - Feb 20, 2026

Tech Leaders Question AI Agents' Value: Human Labor Remains More Affordable

Read more

ICT News- Mar 02, 2026

IDC Report Predicts Surging Smartphone Prices Due to Global RAM Shortage

This development underscores the broader ripple effects of the AI boom on everyday technology, highlighting the interconnected nature of global semiconductor supply chains.

ICT News- Mar 03, 2026

Budget Entry-Level PCs Under $500 to Vanish by 2028 Due to Memory Price Surge

The era of the sub-$500 PC appears to be ending.

How To- Mar 04, 2026

Getting Started with AI: A Newbie's Simple Guide

Are you curious about artificial intelligence but not sure where to begin? You are not alone.

Comments

Sort by Newest | Popular