Shopaholics, You May Need These Personal Finance Apps To Avoid Overspending

Anil - Feb 14, 2020

Here’re some most easy-to-use finance apps that will help you know how much you exactly spent every day

- Guide to Sharing Your Contact Card via the mAadhaar App

- Looking For An iTunes Alternative? Check Out These 10 Apps

- These Photo Editing Apps Will Make Your Picture Perfect

People are shifting from using cash to digital payments when they started realizing the convenience and ‘wisdom’ of making online transactions. Not to mention platforms with built-in budget-tracking features that allows them to check the expenditures in the past, so many personal finance apps out there have been created to help users keep a tab on their budget, but which is the best one for your needs?

Here’re some most easy-to-use apps we want to introduce. By choosing one of them to get well with, you'll know how much you exactly spent every day, especially what did set you back the most.

Walnut Expense Tracking App

This app is designed with detailed finance categories such as food, drinks, and travel. Once the user feels concerned about which specific part has taken up the largest proportion in their wallet, they can check it easily. The app also shows a number of bills within a group, their bank accounts’ balance and prepaid wallets, and so on.

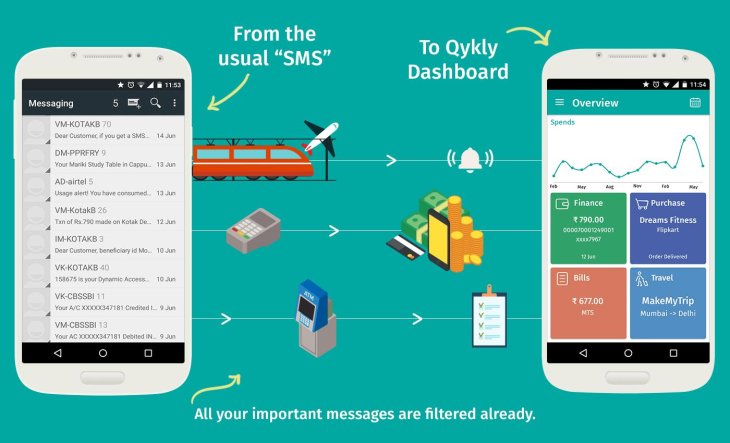

Qykly Daily Expense Manager

Qykly Daily Expense Manager actually groups your finances and income graphically. What’s more, the app will represent the expense analytics to help you remind and analyze your payments in that month. There’s a total of four major groups: finances, purchases, bills, and travel.

mTrakr

Besides must-have basic functions similar to which other finance apps are offering, mTrakr comes packed with an interesting feature that will warn users whenever they overspend. All he/she need to do is to set a budget point for daily expenditure, and then the app will take over all your mistakes.

Users can also keep an eye on their bank/credit card balance. More interestingly, it’ll sum up your income to figure out the amount of tax you need to pay.

Wally

For many iOS and Android users, the handy app ‘Wally’ lets them compare their current income with expenses to schedule a better financial plan. Wally will understand all the details when you scan a receipt: total, venue, and date. It’s the #1 finance app in more than 22 countries and listed as ‘top 10 best budgeting apps” by Forbes magazine.

By the way, you can choose for yourself a profitable card for shopping.

>>> Facebook Pay Will Make Debut Soon, Challenging Google Pay And Apple Pay

Featured Stories

Features - Jan 29, 2026

Permanently Deleting Your Instagram Account: A Complete Step-by-Step Tutorial

Features - Jul 01, 2025

What Are The Fastest Passenger Vehicles Ever Created?

Features - Jun 25, 2025

Japan Hydrogen Breakthrough: Scientists Crack the Clean Energy Code with...

ICT News - Jun 25, 2025

AI Intimidation Tactics: CEOs Turn Flawed Technology Into Employee Fear Machine

Review - Jun 25, 2025

Windows 11 Problems: Is Microsoft's "Best" OS Actually Getting Worse?

Features - Jun 22, 2025

Telegram Founder Pavel Durov Plans to Split $14 Billion Fortune Among 106 Children

ICT News - Jun 22, 2025

Neuralink Telepathy Chip Enables Quadriplegic Rob Greiner to Control Games with...

Features - Jun 21, 2025

This Over $100 Bottle Has Nothing But Fresh Air Inside

Features - Jun 18, 2025

Best Mobile VPN Apps for Gaming 2025: Complete Guide

Features - Jun 18, 2025

A Math Formula Tells Us How Long Everything Will Live

Read more

ICT News- Mar 05, 2026

X Platform Implements Strict Measures Against Fake AI-Generated Videos Amid Iran Conflict

In the meantime, users are advised to scrutinize sources, check for AI indicators, and rely on verified news outlets.

Mobile- Mar 07, 2026

Xiaomi Unveils Cutting-Edge 17 Series Smartphones and Teases Vision GT Hypercar

Xiaomi's MWC 2026 presentation highlights its ambition to dominate not just smartphones but also connected ecosystems and electric vehicles.

Mobile- Mar 06, 2026

Samsung Galaxy S26 Series Sets New Pre-Order Records: Ultra Model Captures 70 Percent of Sales

With such robust initial demand, the Galaxy S26 series is poised to outperform its predecessors in total sales, solidifying Samsung's dominance in the premium smartphone market.

Comments

Sort by Newest | Popular