Oil Price Drops To Historic Lows, Hundreds Of US Oil Companies Might Go Bankrupt

Karamchand Rameshwar - Apr 21, 2020

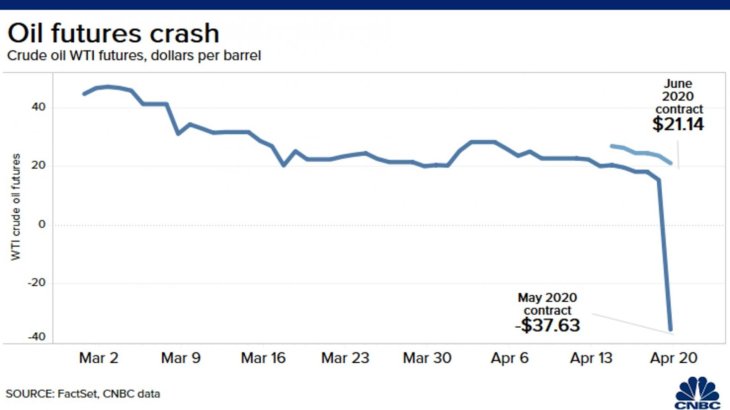

This is the first time oil prices traded in negative territory as the COVID-19 pandemic heavily impact the global demand.

Of all the unprecedented swings in the global financial market since the COVID-19 outbreak, none has been as significant and shocking as the Monday’s collapse the key segment of the oil trading.

The contract for West Texas Intermediate crude (WTI), is the benchmark for the US crude oil prices closed last week at $18.27 (around Rs. 1,400) but on Monday, it plunged to negative $37.63 per barrel (around negative Rs. 2,888)

"Black gold" plunged sharply on Monday when investors worried that the demand of the market would decline due to the impact of the pandemic. In addition, the maturity of the upcoming May contract also has a strong impact on investor transactions.

During the session, WTI crude oil delivered in May on the New York Stock Exchange continuously plummeted and conquered unprecedented and historic low. At some point, the price even dropped to negative $40.32 (around Rs. 3,088). At the end of the trading session, each barrel of this type of oil was only negative $37.63.

But not all the contracts are negative. The June contract for WTI oil fell 10% to $22.54 (around Rs. 1,700), while the July contract traded at $28 (around Rs. 2,146). On London exchange, Brent crude delivered in June also dropped more than 6% to $26.35 (around Rs. 2,020) per barrel.

When the futures contract is about to expire, the price will usually get back to the actual market price of oil. This made WTI delivery in May continuously lose value in the last days. The fact that June and July contracts are still anchored at a higher level partly shows that a part of investors believe that oil prices are likely to recover in the later half of the year.

"Black gold" price was strongly affected when demand dropped because of the lockdown. According to analysts, demand for crude from refineries and tanks in the US is falling sharply when these storage tanks have been filled.

The COVID-19 pandemic dealt a blow to the global economy and reduced oil demand. Meanwhile, OPEC+ and other countries' production cut agreements are not sufficient to offset the demand for fuel that is dropping freely due to the pandemic.

"The real problem of the global supply-demand imbalance has started to really manifest itself in prices," said Bjørnar Tonhaugen, head of oil markets at consultancy Rystad Energy. "As production continues relatively unscathed, storages are filling up by the day. The world is using less and less oil, and producers now feel how this translates in prices."

>>> Thanks To Lockdown, Indian Cities Are Temporary Out Of The World’s Top 20 Polluted Cities

Featured Stories

Features - Jul 01, 2025

What Are The Fastest Passenger Vehicles Ever Created?

Features - Jun 25, 2025

Japan Hydrogen Breakthrough: Scientists Crack the Clean Energy Code with...

ICT News - Jun 25, 2025

AI Intimidation Tactics: CEOs Turn Flawed Technology Into Employee Fear Machine

Review - Jun 25, 2025

Windows 11 Problems: Is Microsoft's "Best" OS Actually Getting Worse?

Features - Jun 22, 2025

Telegram Founder Pavel Durov Plans to Split $14 Billion Fortune Among 106 Children

ICT News - Jun 22, 2025

Neuralink Telepathy Chip Enables Quadriplegic Rob Greiner to Control Games with...

Features - Jun 21, 2025

This Over $100 Bottle Has Nothing But Fresh Air Inside

Features - Jun 18, 2025

Best Mobile VPN Apps for Gaming 2025: Complete Guide

Features - Jun 18, 2025

A Math Formula Tells Us How Long Everything Will Live

Features - Jun 16, 2025

Comments

Sort by Newest | Popular